The cryptocurrency market is witnessing a decoupling event play out in real-time.

Tether (USDT), long considered the unshakeable bedrock of stablecoin liquidity, has hit a wall in its pursuit of a $500B-implied market valuation.

Institutional investors have reportedly balked at the metrics, spooked by transparency concerns and a regulatory landscape shifting toward decentralized alternatives. This stalemate at the half-trillion-dollar mark isn’t just a pricing failure; it’s a signal that risk appetite is rotating.

But here’s the kicker: liquidity isn’t leaving the ecosystem. It’s just moving deeper into the Bitcoin infrastructure. The market is bored with simple store-of-value assets; traders want utility layers capable of unlocking Bitcoin’s dormant capital.

That shift explains the sudden surge in Bitcoin Layer 2 solutions, which are quietly absorbing the liquidity Tether failed to capture.

Investors appear to be hedging against stablecoin stagnation by betting on the ‘programmability’ of Bitcoin. The logic holds up: if Bitcoin is the gold standard, the rails allowing it to transact like Solana or Ethereum are the ultimate pick-and-shovel plays.

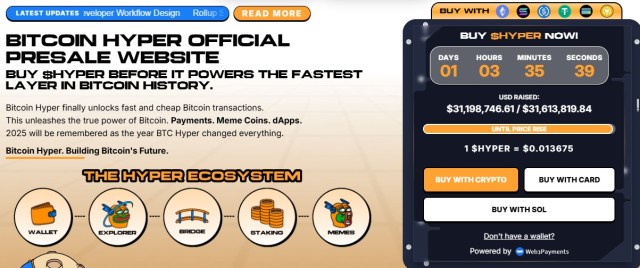

This environment created a perfect storm for emerging protocols like Bitcoin Hyper ($HYPER), which is seeing its valuation climb while Tether’s dominance faces scrutiny.

You can buy your $HYPER here.

Bitcoin Hyper Bridges the Gap Between Store of Value and High-Speed Execution

The core friction point in the current market isn’t a lack of assets, it’s a lack of velocity.

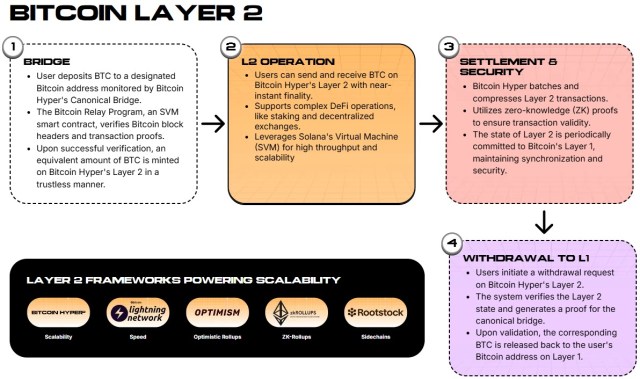

Bitcoin holds over a trillion dollars in value, yet that capital remains largely inert, trapped by slow block times and the absence of native smart contracts. Bitcoin Hyper ($HYPER) answers this bottleneck not just as a sidechain, but as the first Bitcoin Layer 2 to integrate the Solana Virtual Machine (SVM).

Why does this technical architecture matter? It solves the ‘trilemma’ without sacrificing Bitcoin’s security, which is one of Bitcoin Hyper’s mantras.

By using the SVM for execution, Bitcoin Hyper achieves the sub-second finality and low-latency performance DeFi developers require, all while anchoring its state to Bitcoin L1.

Finally, developers can write in Rust and deploy high-speed dApps that actually settle on Bitcoin. For the market, that utility is tangible. The protocol offers a Decentralized Canonical Bridge for seamless $BTC transfers and supports SPL-compatible tokens modified for Layer 2 operations.

This opens the door for high-frequency trading, gaming, and complex lending protocols directly on the Bitcoin network, use cases that were previously impossible. Plus, the integration of high-speed payments in wrapped $BTC with negligible fees addresses the precise scalability issues that have historically held the ecosystem back.

Check the $HYPER presale.

Whale Accumulation Signals Confidence With Over $31M Raised

While Tether struggles to justify its valuation, smart money is aggressively positioning itself in the Bitcoin Hyper presale. The sentiment contrast is stark. According to official data, the project has raised over $31.2M. That figure suggests robust institutional confidence, even as the broader market hesitates on stablecoins.

Traders watching this setup will notice this pattern often precedes retail adoption, as whales position themselves before the Token Generation Event.

Frankly, the tokenomics look designed to discourage mercenary capital rotation. With the token currently priced at $0.0136751, early participants are eyeing immediate staking opportunities post-TGE. The protocol offers high APY staking rewards, with a modest 7-day vesting period for presale stakers to prevent immediate dump pressure.

For investors fatigued by the regulatory ambiguity surrounding centralized stablecoins, the programmatic certainty of a Bitcoin L2 offers a compelling alternative, while the presale performance creates the expected FOMO.

Buy your $HYPER today.

Disclaimer: The content of this article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments, including presales and Layer 2 tokens, carry inherent risks. Always perform your own due diligence before investing.